Credit report overview

- Project: Improving the Credit report area

- Role: Lead Designer

- Date: May 2023 - Sep 2023

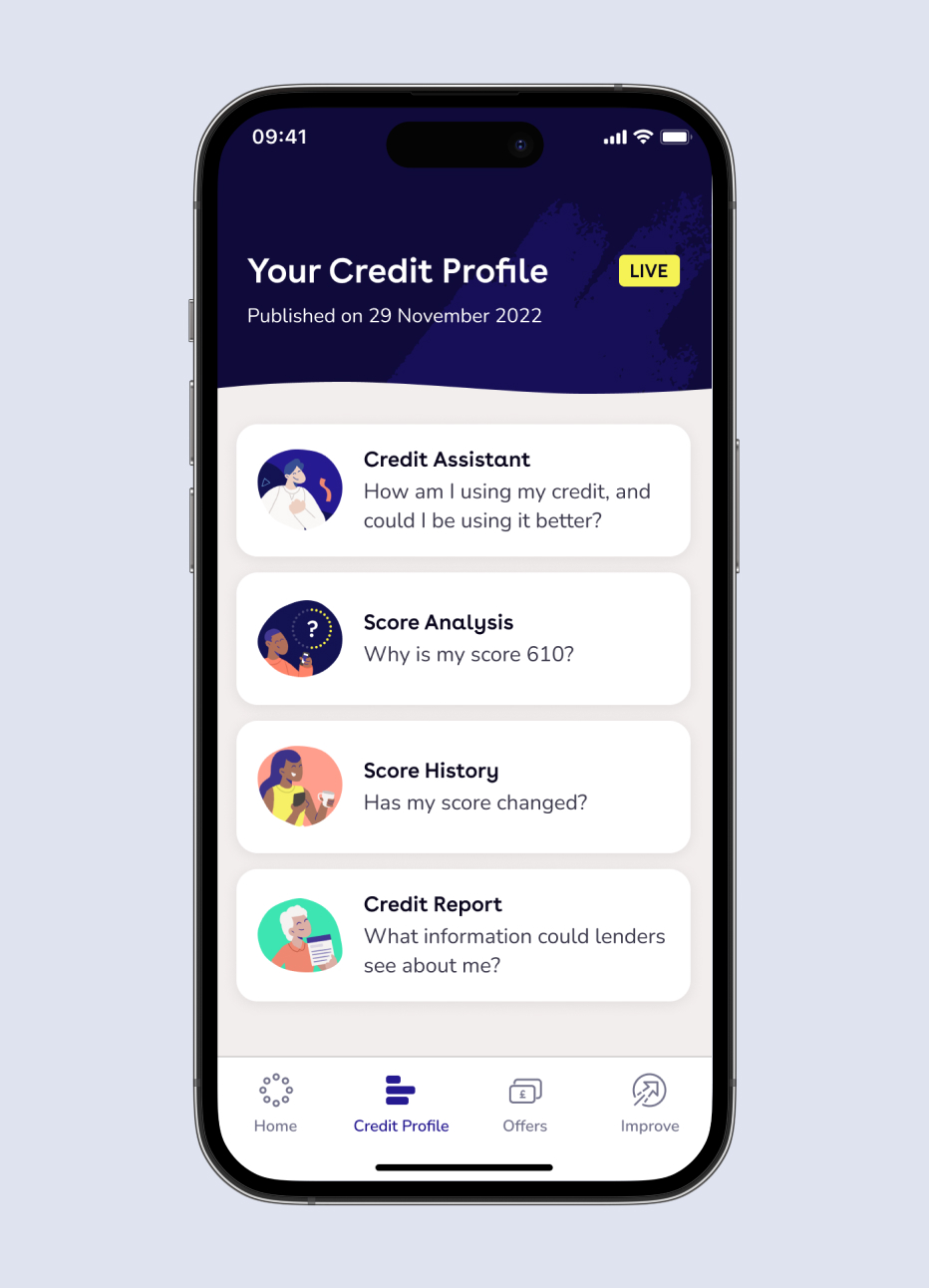

- Description: Making the Credit profile section more engaging by surfacing valuable content and providing users with an easy-to-understand, digestible and actionable area.

The problem

The credit profile section was mainly used as a navigational area. Of the total visit of the area, 29% of customers abandon their journey here and 30% of customers were clicking more than one section, perhaps indicating lack of clarity on what they want to navigate to.

The goal

We wanted to enhance the Credit Profile section to give customers a comprehensive financial overview and empower them with clear financial insights.

And as part of the App AI plan, we wanted to:

- Evolve this page to be one step closer to the new IA structure

- Give customers snippets of data that could be relevant to customers to track their progress

- Highlight anything that has changed on their credit report

The principles

- Encourage to empower

We create experiences that celebrate the customer on good days and support them on bad days

- Knowledgeable and insightful

We turn complex data into easy to understand insights to reassure our customers that they are making the right financial decisions for them.

- Personalisation with purpose

We tailor our product to our customers to help them achieve their unique goals.

The research

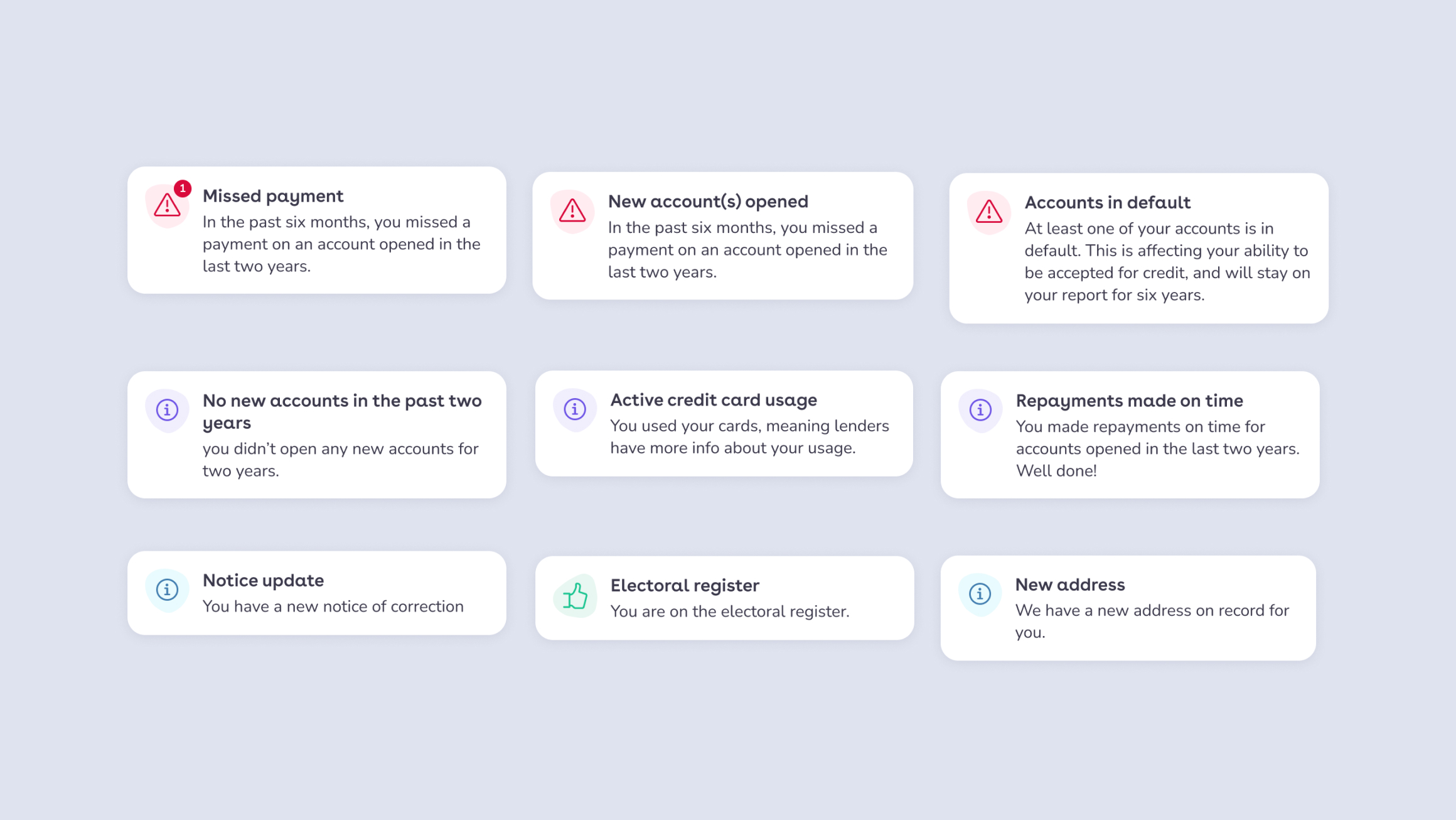

Past research highlighted that customers:

- Valued being informed about their missed payments

- Have more info on hard searches

- Know more about their Credit balances

- Find the information early on

The design exploration

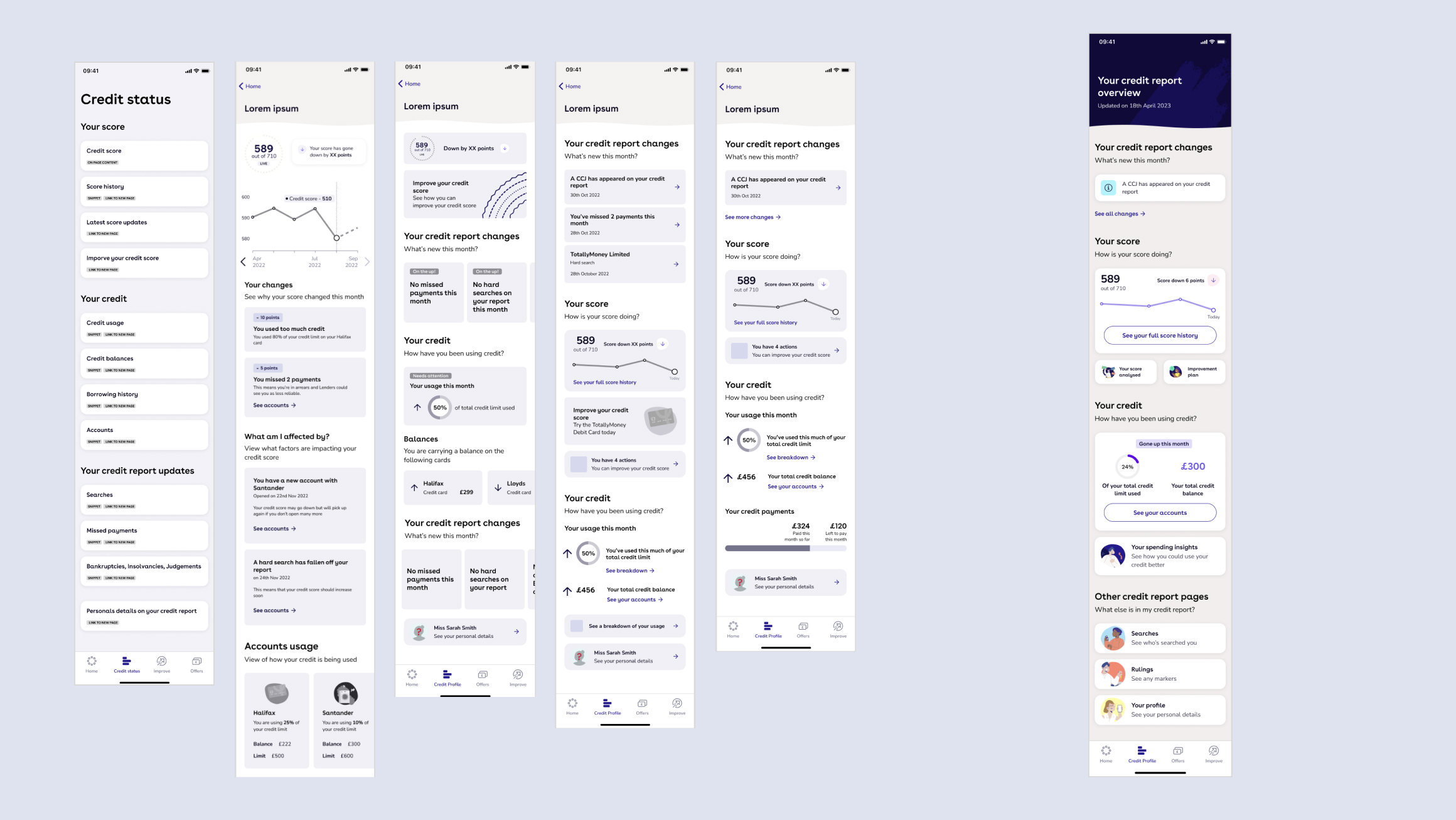

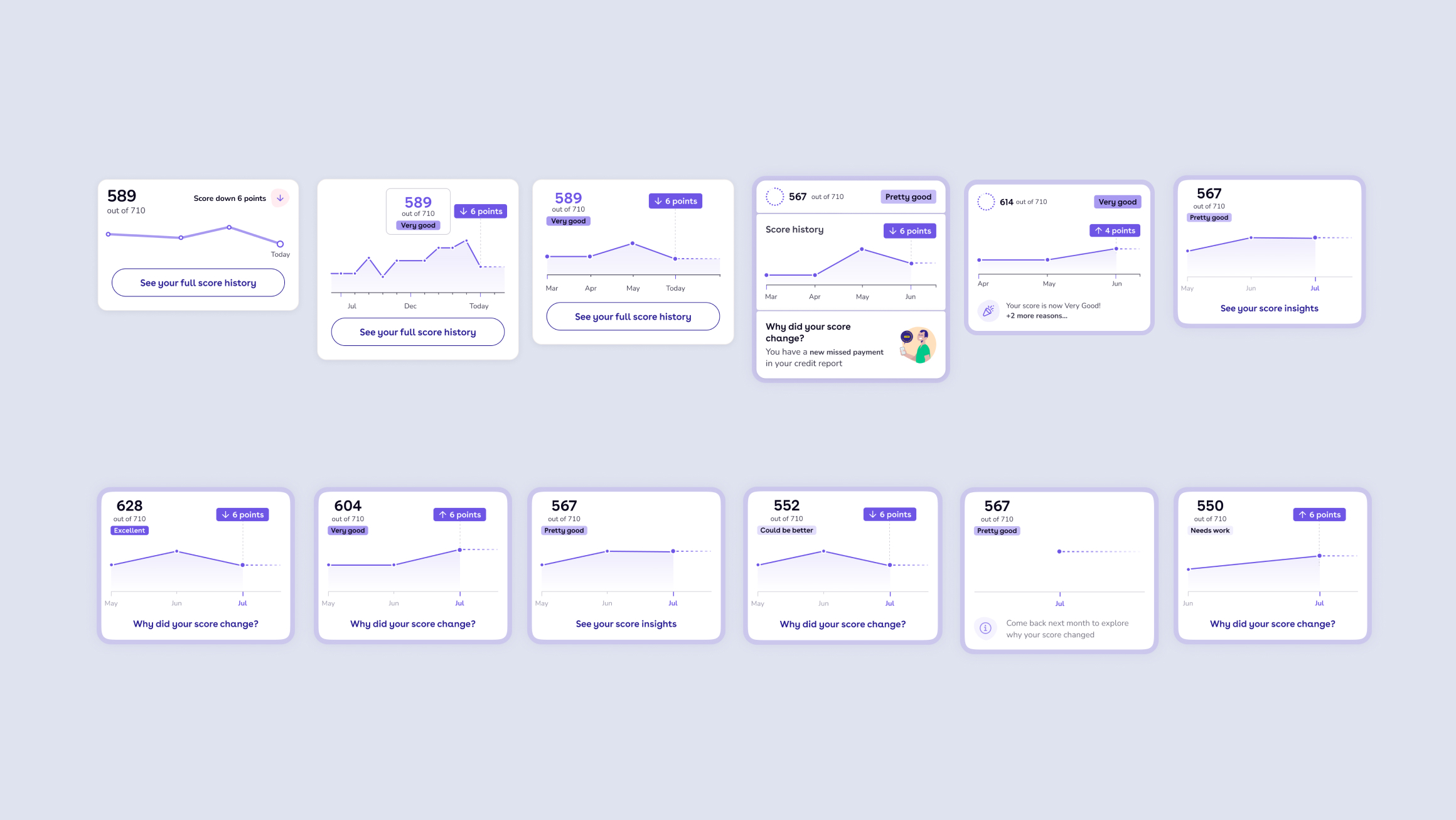

First concept testing

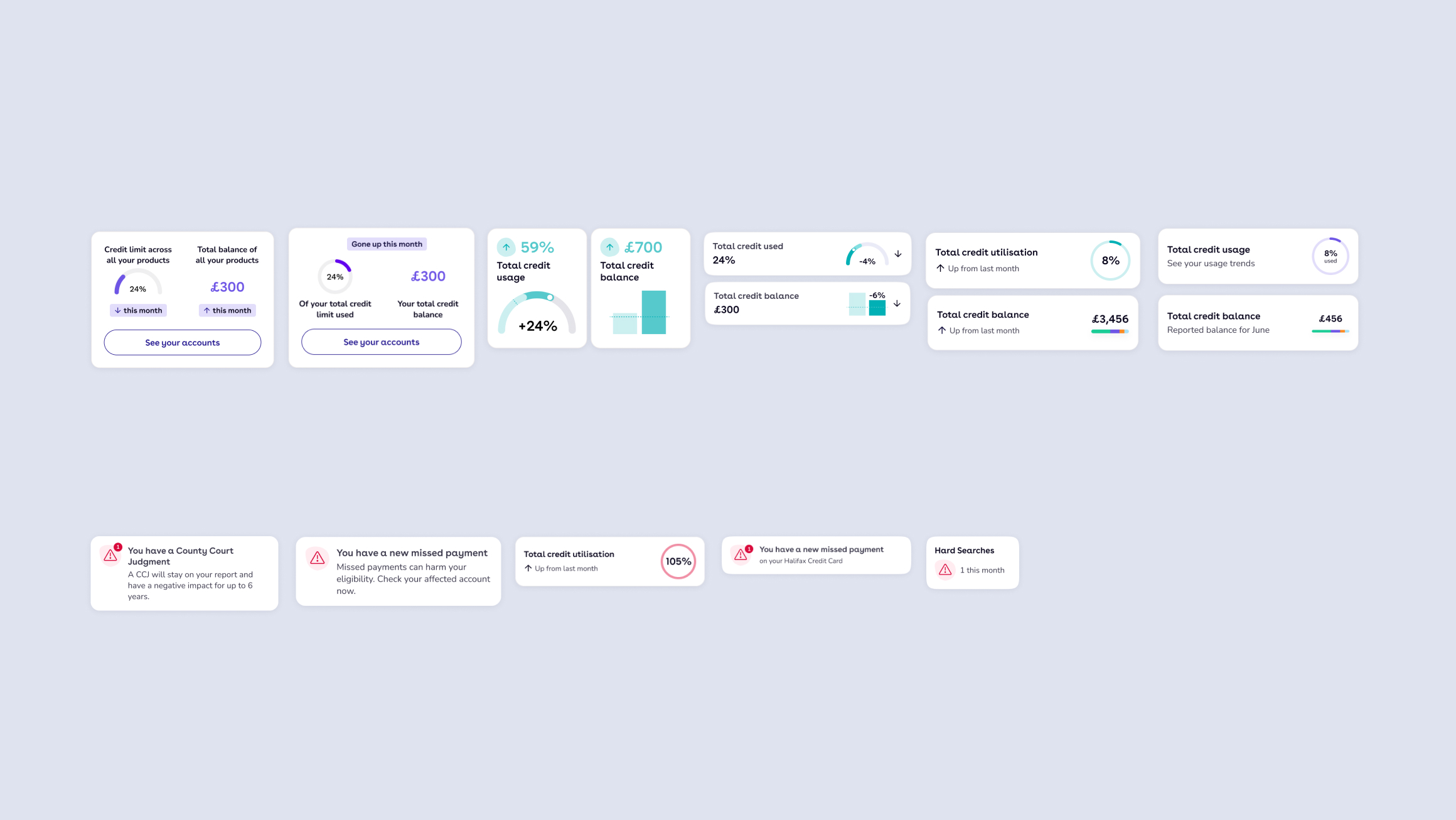

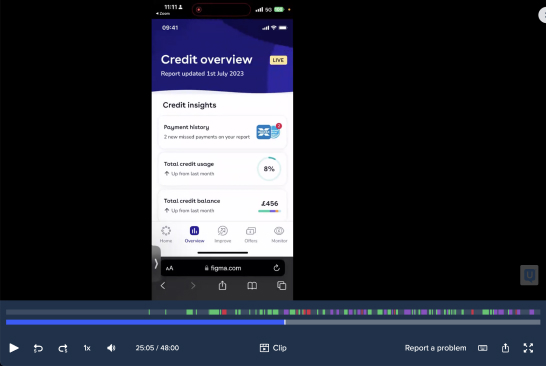

Lorraine, the previous designer in the mission, had developed a series of initial concept and then tested the design on the right with moderated interviews. She found out that customers had some confusion on labelling and technical language, they liked data visualisation and they had an overall confusion regarding the meaning of credit balance and credit usage.

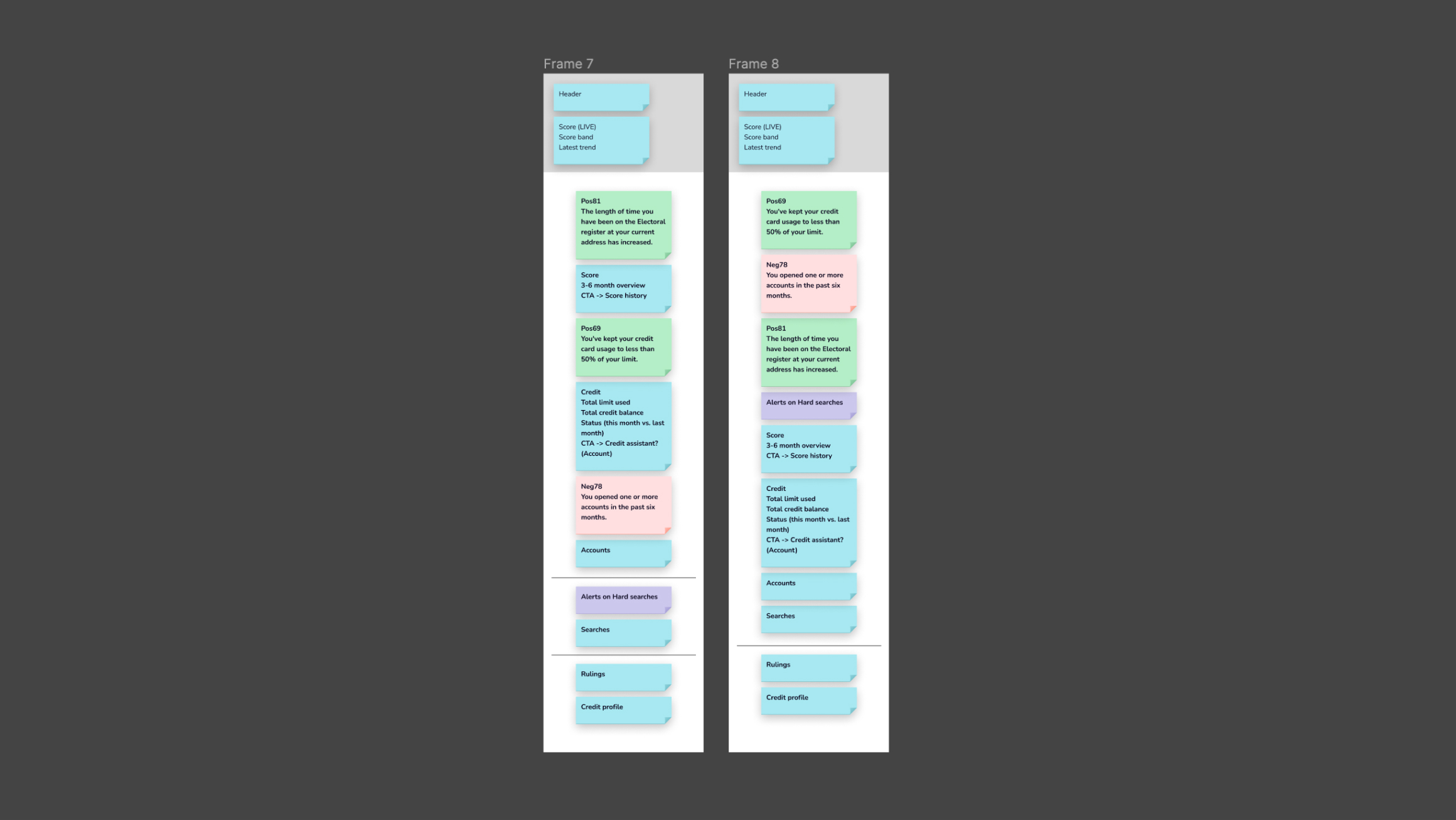

Second concept testing

Building upon the insights gained from the initial concept testing, I eagerly seized the reins of the project. With a meticulous approach, I embarked on the journey to map out the intricate structure, carefully considering each element that would contribute to the project's success. In my role as the project lead, I delved into refining the project's MVP, envisioning not just a product but a seamless experience. The exploration didn't stop at aesthetics; it extended to innovative features and functionalities.

User testing findings

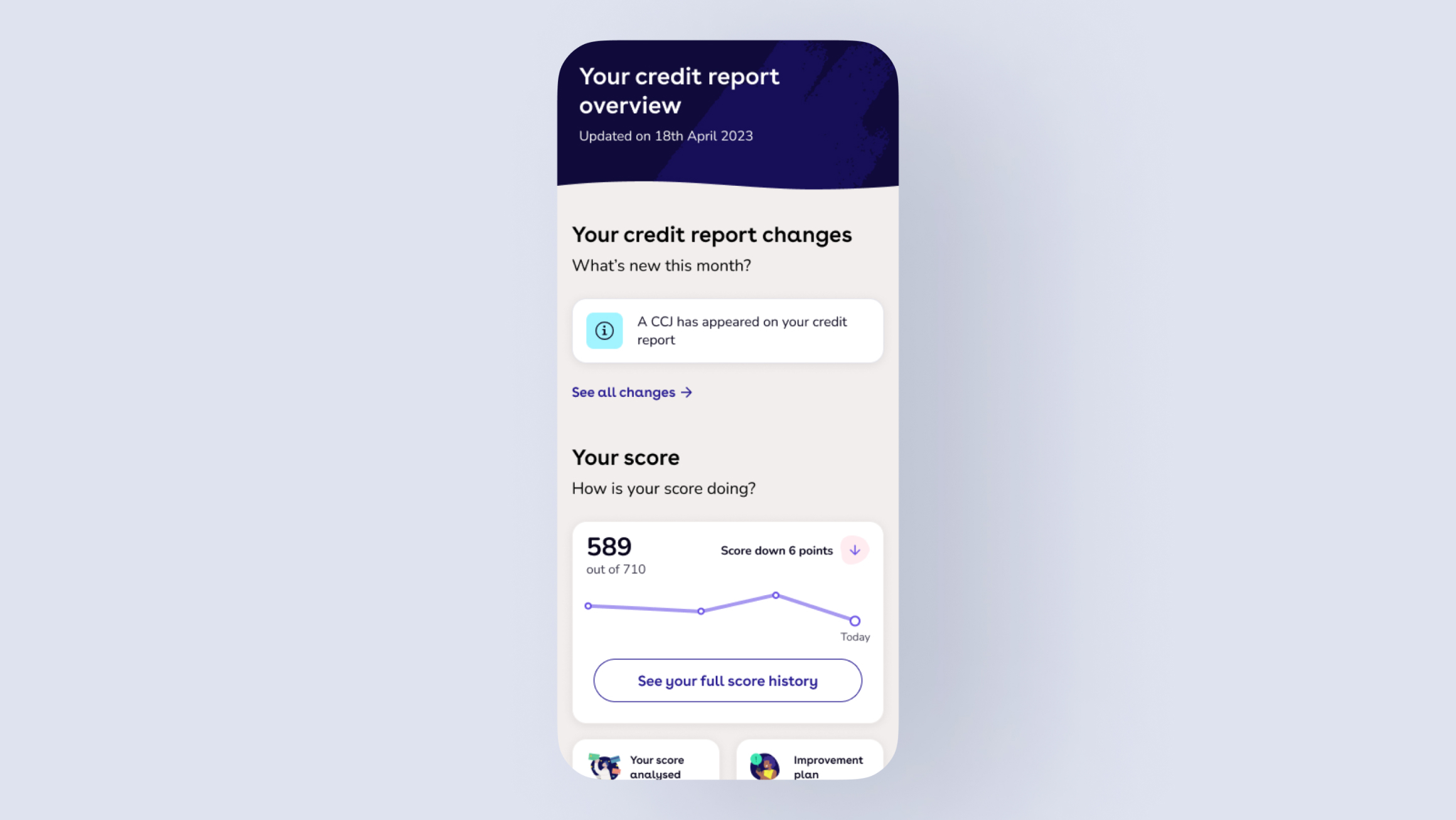

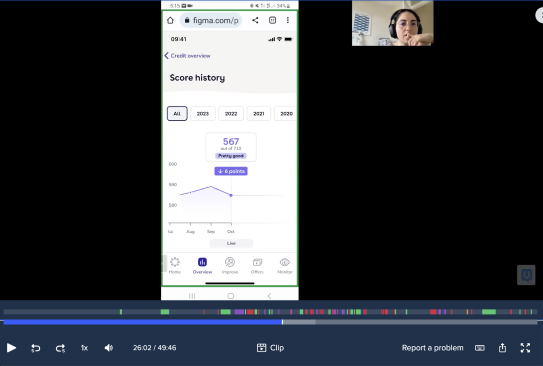

Score timeframe to include data axis

Users felt the data visualisation lacked context for the other two data points on the chart. They recommended adding more data to the axis.

Entry point for Personalised plans

The majority of users found the information on the Personalised plan card useful to get where they stand but some users felt it was lacking a bit of context.

Simplify the credit insights section

Users were a bit confused if the trend we were highlighting 'Up from last month' was in some way connected with the data presented on the component.

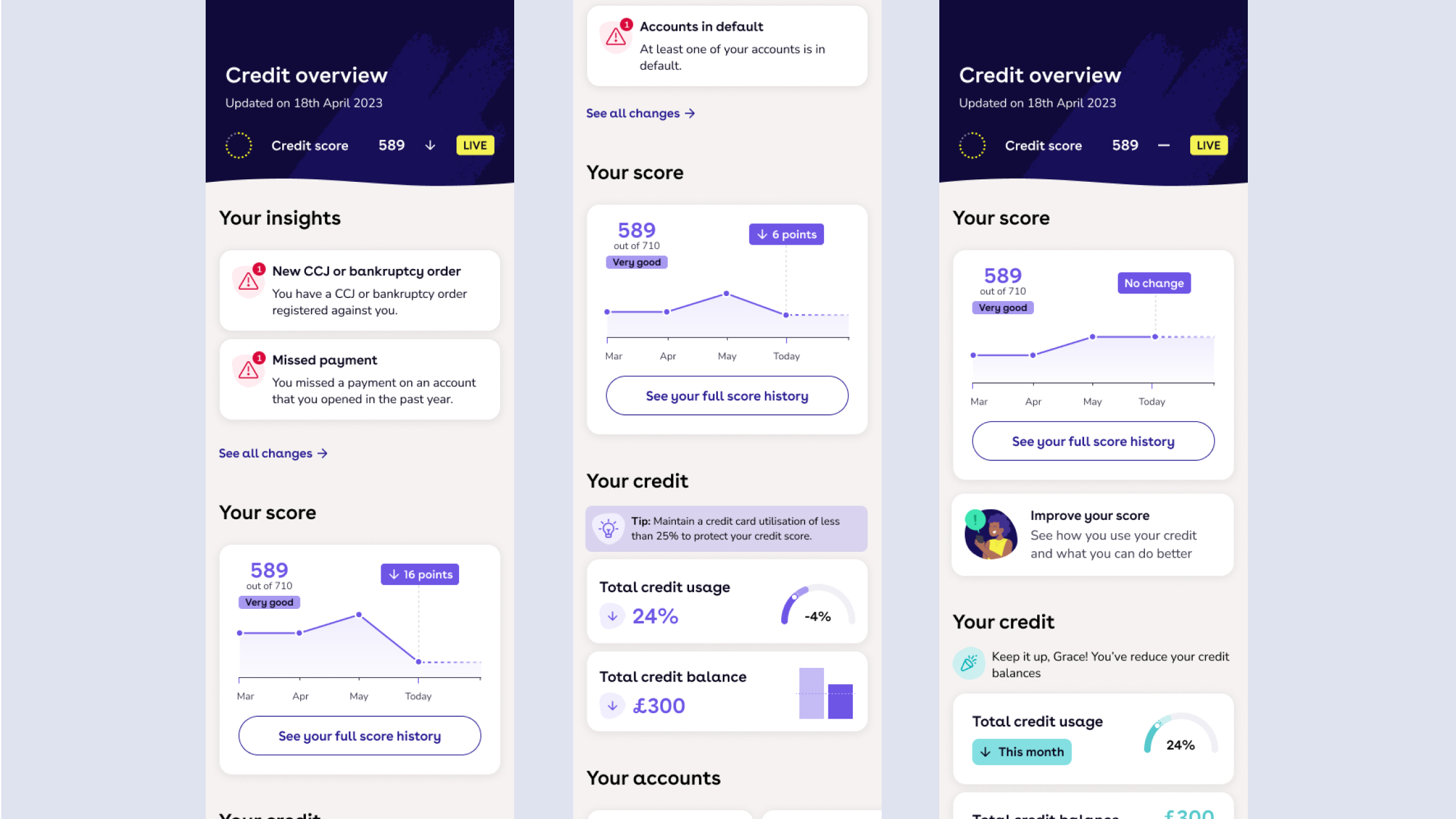

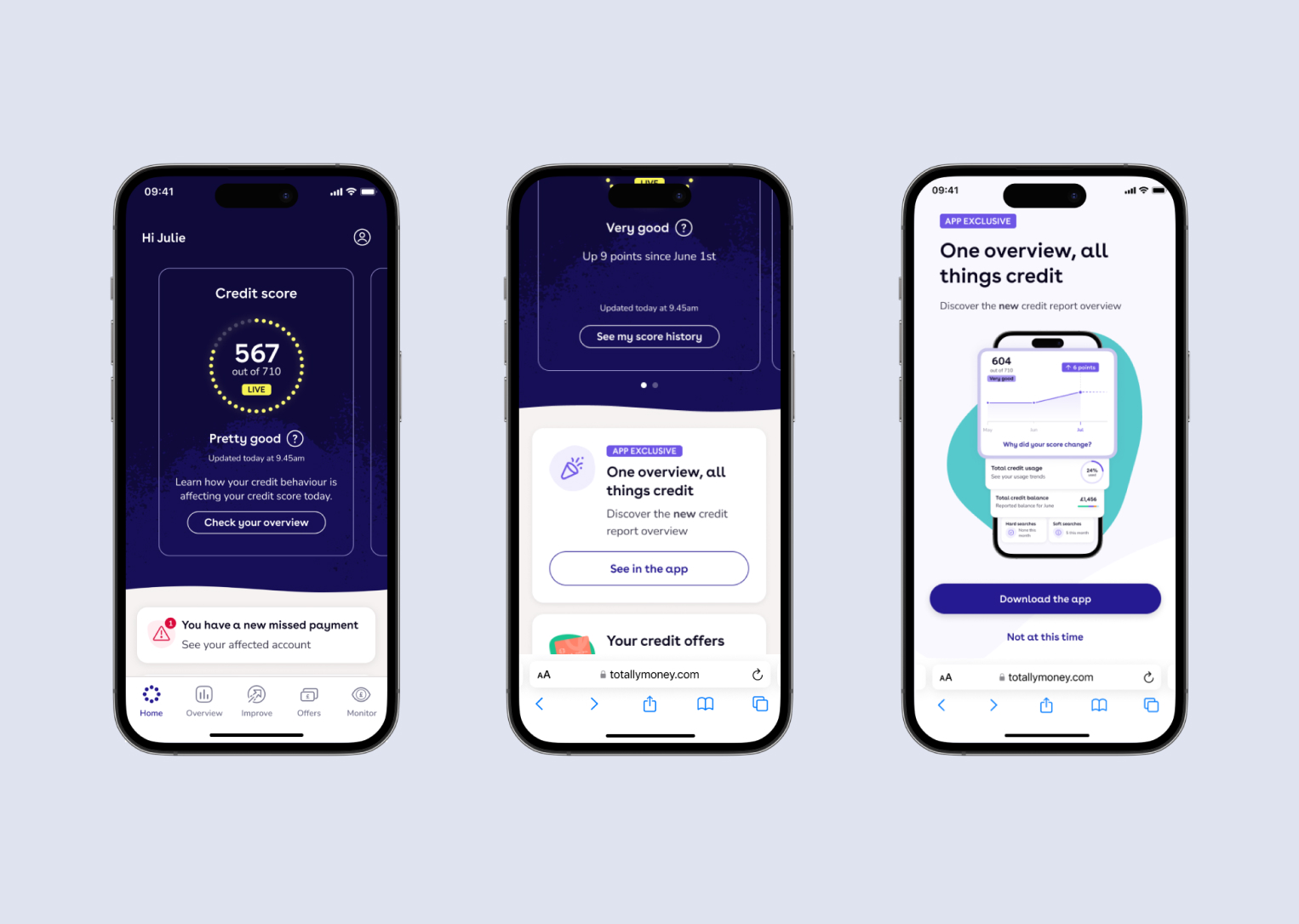

Final design

I worked closely with engineers and the copywriter, throughout the whole project, to verify the design and copy implementation. Along with weekly stand ups, we would occasionally sit together and conduct a performance review of the final designs.

After implementation, I initially tested the design and invited the whole mission to check functionality. After confirming that everything was working as it should I’ve invited the whole company to help us test and spot any inaccuracy.

Two weeks post the MVP launch, the Product Manager and I decided to implement a feedback module. We wanted to gather valuable insights on the new area. We introduced an open-form so users could give us any suggestions for improvement. We aimed to gather 500 responses (1-5 rating) alongside 150 comments. This extensive data collection aims to foster a comprehensive understanding of user sentiments and identify key areas for enhancement.

Results

69% of our customers rated the Credit report overview between 4-5 stars

What did customers like?

- Clarity: Many customers praised the app for providing clear and informative content

- Usefulness: Customers appreciate our app’s clear and informative content, finding it highly useful in managing credit and improving scores

- User-Friendliness: Several users praised the app for being user-friendly and guiding them in managing their credit

But we didn’t stop there...

We aimed to incorporate an entry point on the homepage specifically for customers who hadn't experienced a score change. Additionally, our strategy involved actively promoting this novel feature on the web, with the overarching goal of boosting overall app adoption. We decided to target both the Homepage, as well as the Credit report area, by showing an interstitial that would appear to customers once, mitigating any potential friction and ensuring a smooth user experience.

Business impact

The Credit report overview area has experienced a modest uptick in visits, prompting our commitment to ongoing tracking for a more nuanced understanding of retention dynamics. Despite an initial dip, the interconnected areas related to the page have displayed a noteworthy turnaround. Month-on-month, we observe a gradual resurgence, indicating positive momentum and recovery. We are currently driving ~500 downloads weekly. We want to experiment with an alternative message to assess its impact on driving downloads. Additionally, we plan to enhance the Credit Report area by creating more personalised messages.